NEWS

Pacifico Energy Expands Alternative Investments Team with Senior Hire to Focus on Opportunities Arising from Need for Additional Electricity Resources in United States

- Los Angeles, CA (July 16, 2024) – Pacifico Energy has announced that Leon J. Persaud ...Read more...

07/16/2024

NEWS

Pacifico Energy signs Investment Declaration with Korea's MOTIE for offshore wind in South Jeolla

- (from left) Dukryul Park, director general for cross-border investment policy at the Ministry of Trade, ...Read more...

06/28/2024

.jpg)

PRESS RELEASE

Pacifico Power clears $93mm in total transaction value in its first multiphase tax equity financing of key distributed energy projects in partnership with Sumitomo Corporation and Mitsubishi UFJ Financial Group

- The combined $29mm construction-to-permanent debt facility, $24mm transferability bridge loan, and $40mm tax equity commitment ...Read more...

06/26/2024

NEWS

S. Korea bags US$610mm investment from 3 U.S. firms

- Industry Minister Ahn Duk-geun speaks during a reception in Washington on June 26, 2024 (U.S. ...Read more...

06/26/2024

NEWS

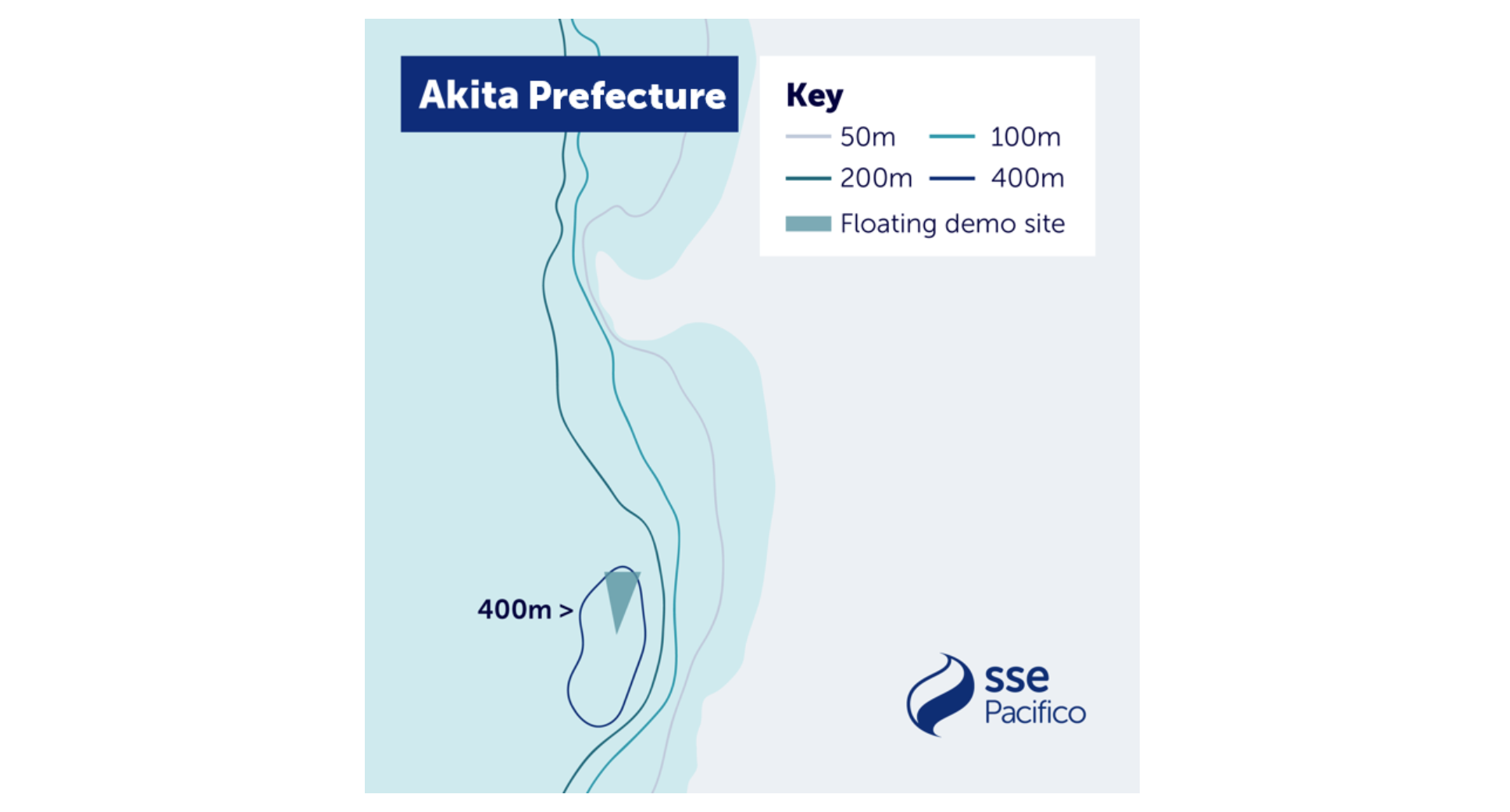

SSE Pacifico and partners secure public funding for Japanese floating offshore wind demonstrator

- 30MW demonstrator will be among the deepest anywhere in the worldFollows competitive process administered by ...Read more...

06/13/2024